No-Code AI

Decision-Making Software

business insights.

process with cutting-edge AI and boost your productivity

to 45%

portfolio

data insights

customers

Automated Decision-Making Platform

No need to have ML engineers or large teams of data scientists on board. GiniMachine AI-powered decisioning platform can process terabytes of historical data. It builds, validates, and deploys predictive models in minutes, not days.

Credit Scoring

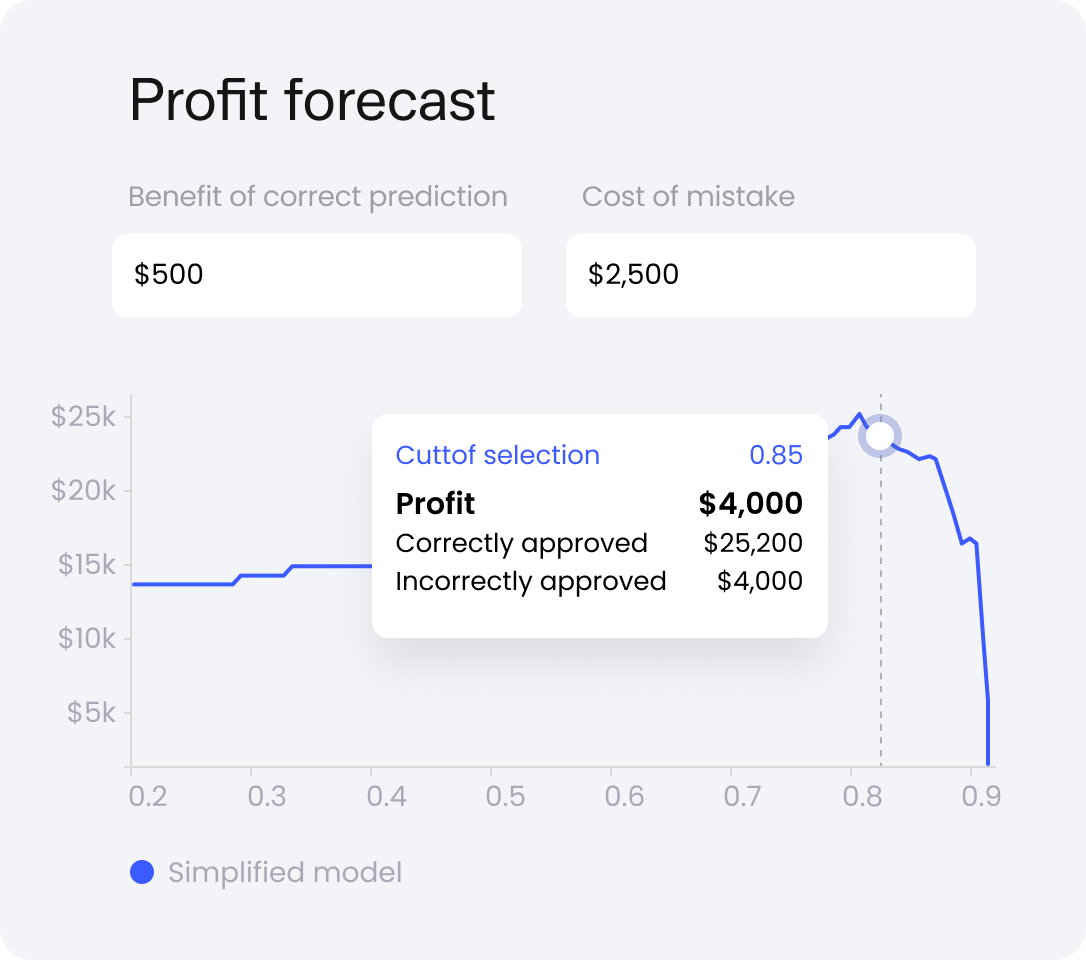

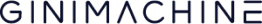

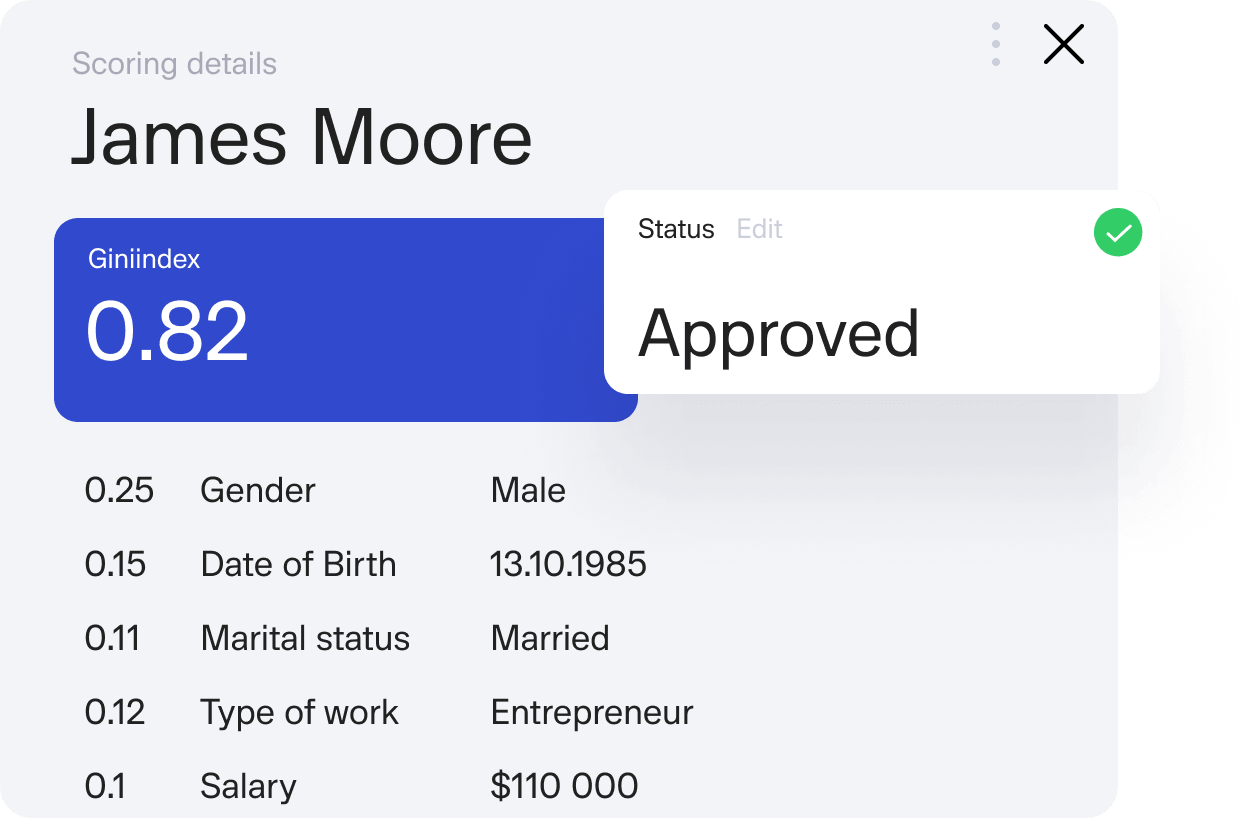

Sweep away the limitations of traditional credit scoring. Empower your business with AI underwriting decision software, unlocking the potential to extend loans to even thin-file borrowers. Discover the perfect harmony between maximizing profits and managing risks.

Learn moreCollection Scoring

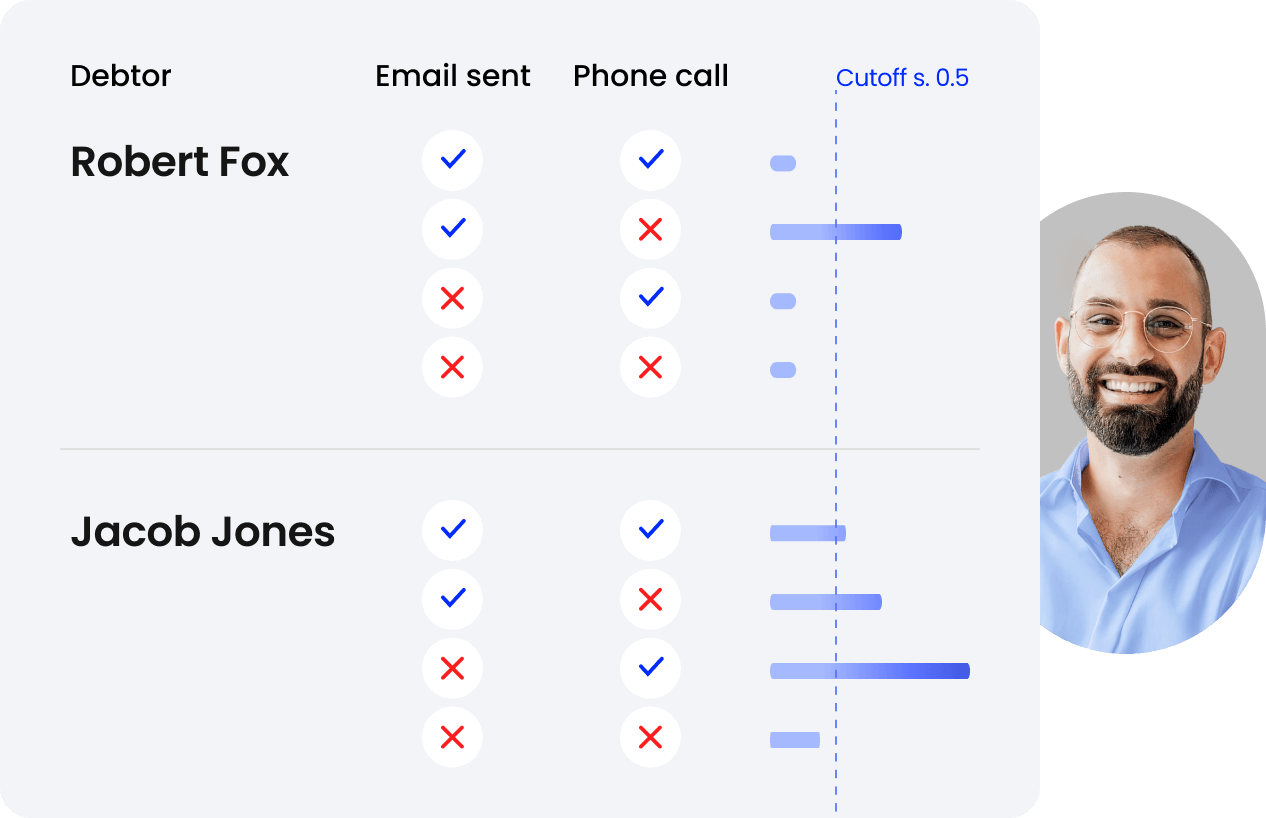

GiniMachine helps to prioritize debtors primed for fast payback. It suggests the most effective collection tools, be it calls, messages, or other methods, based on scoring parameters. The outcome? A significant boost in productivity for collection businesses and a swift goodbye to time wasted on non-performing debts.

Learn more

Fast and Free Credit Department Audit

No-Code AI Predictive

Modeling

balanced decision-making across a variety of business types. Select your industry

to explore the advanced features of GiniMachine.

Debt Collection

Agencies

AI software for debt collection agencies fuses data analytics and machine learning to maximize debt recovery efficiency. Focus your collection efforts on accounts brimming with repayment potential, optimizing resources and trimming operational costs. GiniMachine crafts tailor-made debt collection strategies, creating a streamlined workflow that minimizes manual labor.

Learn more

Alternative Lenders

GiniMachine scores credit applications and loans using diverse alternative data sources,

from rental and utility payments to

asset ownership and public

records.

It’s like having a

crystal

ball as it zeroes in on high-risk assets and anticipates

loan

repayments. Streamline

your operations with an automated

pre-approval system for incoming

applications and

fine-tune

your credit portfolio risk.